GDS payment tool Gov.uk Pay enters beta testing

Four departments sign up to trial prototype Government-as-a-Platform service

15/10/15: Gov.uk Pay, the government's prototype digital payment platform, entered beta testing today with four Whitehall departments.

Companies House, along with the Ministry of Justice, Home Office and the Environment Agency, will begin taking payments through the new mechanism from today, according to the Government Digital Service (GDS).

Till Wirth, product manager for the platform, wrote in a blog post: "We've already talked with many of our colleagues across government to find out how they currently take payments and how that could be improved.

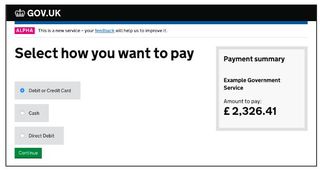

"We're now starting to intensify that research and focus on taking credit and debit card payments for some online transactions of our partners."

There is no public deadline for the beta trial period, and the GDS said it will not launch Gov.uk Pay more widely until it meets users' needs as well as the government's security requirements.

However, the GDS is now working with the four participating departments to understand what people using their services need from a payment platform.

Wirth said: "In the coming weeks we'll collaborate with these partners to make sure we fully understand the needs of citizens using the payments service and the civil servants administering the payments. The developers in our team will also start pairing with our partner's developers to focus on technical integration."

Get the ITPro. daily newsletter

Receive our latest news, industry updates, featured resources and more. Sign up today to receive our FREE report on AI cyber crime & security - newly updated for 2024.

IT Pro asked the Cabinet Office whether users can sign up as beta testers, and how many users the beta test will likely involve.

The GDS also plans to develop a direct debit payment method early next year, after the DVLA recently implemented one itself.

Gov.uk Pay is another example of the GDS's Government-as-a-Platform (GaaP) model, in which common components are developed in-house or with providers to be shared among departments in an effort to cut out costly duplicated IT systems.

23/07/15: A prototype payments platform that could transform the way people pay for government services has completed its first stage of testing, it was confirmed today.

The Government Digital Service (GDS) has spent the last few months developing and trialling the service with the Department for Work and Pensions (DWP) and the Insolvency Service.

The platform aims to offer the public an easier way to pay government by providing a mechanism similar to that of Amazon.

It will replace the different payment methods employed by various Whitehall departments with one easy, consistent way to pay for transactions related to things like passport renewals, new driving licences, environmental permits and tax.

People will be able to use the platform from their PCs as well as their tablets or smartphones, too.

GDS worker and product manager Till Wirth admitted Whitehall's current payments landscape is "not a good user experience, and it's not very efficient."

In a blog post published today, he added: "E-commerce companies spend lots of time and effort creating a seamless check-out process. They design easy-to-use payment pages, and offer users a choice of convenient payment options.

"We think government should be able to do the same thing, making public sector payments equally user-friendly, both on mobile devices and desktop computers."

This will make it easier for an estimated two million UK citizens who do not have bank accounts to pay for services, he said.

The payments platform was first mooted in February by former Cabinet Office minister Francis Maude, who said a working prototype would be one of the first examples of Government-as-a-Platform.

This initiative will see the GDS develop common, standardised IT systems that can be adopted across departments to cut down on expensive outsourcing and costly duplicated projects.

This will be one of the key benefits of the payments platform, Wirth said, because departments will be able to easily integrate with it through APIs the GDS has already created.

"Using the platform would make it quicker and cheaper for the government to launch new services, since it avoids unnecessary repetition of the same procurement and integration work every time," he added.

Currently, government departments must spend a significant amount of time and money processing credit and debit card payments, as well as e-wallet transactions.

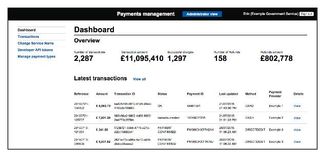

Instead, the payments platform would introduce one reporting interface that shows all payment types, and the GDS is considering hiring external providers to make the process more efficient.

Millions of refunds issued to the public each year would no longer be made with cheques, the GDS added, instead issuing the refunds directly to the cards used to make the original payments.

Fintech innovation

Using the payments platform would also open up the doors to faster innovation, the organisation claimed.

Wirth wrote: "At the moment, each government service is directly integrated with certain payment and security functionality, making it tough to launch new products. For a cross-government change to happen, hundreds of services would have to adapt their existing front- and back- end integrations. That's a great deal of work.

"By contrast, a single change made within the payments platform would instantly be available as new functionality to every service using it. Very little work, resulting in instant, cross-government change."

Alpha and Beta

Since improving the service after the alpha trial phase with the DWP and the Insolvency Service, the GDS has also created a version of the backend civil servants can use to issue refunds.

This will likely change with more feedback and user research, and the upcoming beta phase will see "two or three" departments begin to trial the platform, taking card payments from citizens.

Wirth said: "We'll then focus on fine-tuning the API and the self-service components, making it as easy as possible for government services to adopt the platform. We'll also add new payment types so that users can chose the most convenient way to pay."

IT Pro asked the Cabinet Office when the beta trial would begin, and which departments will take part, but had received no reply at the time of publication.

GaaP

Other examples of GaaP already exist in Whitehall, with one being Gov.uk Verify, the GDS's identity assurance platform.

The service has suffered multiple problems on its way to a beta status, with the platform at one point not working for 40 per cent of users, while just last month many married couples were unable to access a tax break through the system.

Kable analyst Jessica Figueras yesterday told IT Pro that while GaaP will create savings as Whitehall moves away from legacy contracts, the transition could take years.

"You don't have the whole government switching overnight," she said. "It might well be that they're not in a position to use the service. There's a huge amount of lag."