How to use Apple Pay in the UK: Everything you need to know

Apple Pay users will hit 86 million this year

Apple Pay is Apple's contactless payment solution. Here, we'll breakdown what is, how you use it, and the latest news on the serivce.

Latest news

12/04/2017: Apple Pay is being used by 86 million people, almost doubling its take-up in the last 12 months, according to Juniper Research. It makes the contactless payment technology the favourite by far, with the second most popular service, Samsung Pay, being used by 34 million people and Android Pay by 24 million.

Juniper predicts the number of people using mobile contactless payments will reach 10 million in the next few months, surpassing 150 million by the end of the year.

In total, the three mobile payment options increased their market share of the contactless market to 41% in 2016, compared to just 20% back in 2015. Juniper thinks this will increase to 56% by 2021.

However, major payment providers such as PayPal threaten Apple's position, with analysts predicting they have the infrastructure to launch a similar payment option much faster than mobile developers.

But it's not all bad news, because Juniper Research noted that mobile contactless payments will continue to gain traction across the world and has the potential to take over from the use of contactless debit cards, for example.

"We believe that as contactless usage gains traction and consumers/merchants recognise the speed and convenience it offers, then, as in European markets, there will be a further and significant increase in availability at the point-of-sale," the report's research author, Nitin Bhas, said.

Get the ITPro. daily newsletter

Receive our latest news, industry updates, featured resources and more. Sign up today to receive our FREE report on AI cyber crime & security - newly updated for 2024.

Apple has already revealed retailers are fully supportive of its contactless solution, with 35% of retailers accepting it at the end of 2016, compared to just 4% in 2014.

14/07/2016: European consumers are keen to use biometrics when paying for goods, according to a new survey. The news gives a boost to payment services such as Apple Pay, which relies on biometrics for increased security.

In a survey of over 14,000 European consumers by Visa, two-thirds want to use biometrics when making payments and nearly three-quarters (73 per cent) see two-factor authentication, where a biometric is used in conjunction with a payment device, as a secure way to confirm an account holder.

The study found that online retailers have the most opportunity for gain as nearly a third (31 per cent) of people have abandoned a browser-based purchase because of the payment security process.

But Jonathan Vaux, executive director of Innovation Partnerships at Visa Europe said that one of the challenges for biometrics is scenarios in which it is the only form of authentication.

"It could result in a false positive or false negative because, unlike a PIN which is entered either correctly or incorrectly, biometrics are not a binary measurement but are based on the probability of a match," he said.

Vaux added that biometrics work best when linked to other factors, such as the device, geolocation technologies or with an additional authentication method.

27/05/2016:Apple wants to expand Apple Pay to more countries worldwide, reports TechCrunch, focusing particularly on Asia and Europe.

Jennifer Bailey, VP of Apple Pay, said: "We're working rapidly in Asia and also in Europe, our goal is to have Apple Pay in every significant market Apple is in.

"We have announced Hong Kong [and], across the [Asia Pacific] region, we're talking to many partners and banks and evaluating how quickly we can bring Apple Pay to new markets."

The service was recently expanded within Singapore, and now supports five of the country's major banks and 80 per cent of cards after launching in April. Apple Pay is also used in the US, Canada, the UK, Australia and China.

Possible locations for the service to move into this year include France, Hong Kong, Brazil and India.

"First, we look at the size of the market for Apple products," Bailey continued. "We also look at credit and debit card penetration, and [existing] contactless payment coverage.

"[But] when we bring Apple Pay to market even when contactless is low it will grow - it was 4 per cent in the US and is now 20 per cent. We also work with our network partners, where we can utilise integration with Amex and Visa, to go to market quickly."

16/05/2016: The CEO of the DVLA has hinted that driving licences may be added to Apple Pay in the future. Oliver Moreley posted a picture of a UK driving licence displayed on an iPhone within the Apple Wallet app, with the caption "So here's a little prototype of something we're working on#drivinglicence," from his Twitter account.

The picture showed what looks like a slightly tweaked version of a current photo driving licence, showing the driver's name, date of birth, issue and expiry date, alongside their picture.

Not only does it demonstrate the scope of the Wallet app - covering everything you would normally find in a physical wallet, including loyalty cards, payment cards and identification, it also shows how the government is being expected to adapt by digitising many of its services.

However, there are lots of challenges the DVLA needs to overcome before digital driving licences will become mainstream, such as verifying the identification is genuine rather than a stolen identity or a fake and preventing identity theft.

Last month, it announced the phasing out of paper driving licences, meaning drivers are only expected to present their photocard when asked for proof of ID and right to drive by the police.

05/04/2016: Barclays and Barclaycard have confirmed that customers can now use Apple Pay, almost nine months after the the service was introduced.

Barclays customers can now make payments using an iPhone, iPad, or Apple Watch at more than 400,000 locations in the UK, including London's transport network, if they have the app.

The bank had delayed adopting Apple Pay as it promoted its own contactless payment solution, and now becomes one of the last UK banks to endorse Apple Pay.

This announcement has prompted suggestions that Barclays will also support Android Pay when Google's own contactless payments tool launches this summer, but Barclays has not given any confirmation of this.

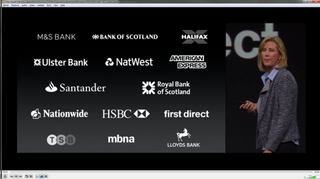

Barclays joins a fleet of UK banks supporting Apple Pay, which include Bank of Scotland, First Direct, Halifax, Lloyds Bank, M&S Bank, MBNA, Nationwide, NatWest, Royal Bank of Scotland, Santander, Tesco Bank, TSB and Ulster Bank.

29/03/2016:Apple will launch a browser version of its mobile payment service, Apple Pay, later this year, according to reports.

The new service will be available on Apple's Safari browser on iPhone or iPad models with TouchID fingerprint technology, reports Re/code, before possibly becoming available on Macs in the future.

An announcement of the expansion is expected at WWDC, Apple's developer conference that ordinarily takes place in June, but nothing has yet been confirmed. If it does go ahead, the move puts Apple in direct competition with PayPal.

26/02/2016:Apple Watch and iPhone users will be able to use the London Underground for free for the next three Mondays if they have a MasterCard account linked to Apple Pay.

Eligible users can thentouch in and out with their iOS device at any time on Monday 29 February, Monday 7 March and Monday 14 March.

Travellers can use the Tube, Overground, Bus, TfL Rail and river boat services up to a value of 28.10, which will then be refunded to the user's MasterCard account within 28 days.

05/02/2016: Barclays has announced it will adopt Apple Pay, meaning the bank's customers will be able to use the service soon. Although Barclays didn't offer up an actual release date for the service, the company's CEO said it will become available for customers to use between 26 March and 10 April.

A Barclays executive sowed the seed of speculation, responding to a customer who asked when the service will launch at the bank, confirming via email it will be offered "in the next 60 to 75 days."

Barclays is one of the last banks to support Apple's mobile payment solution, which is surprising considering it's the second biggest bank (in terms of assets) in the UK behind HSBC.

28/01/2016: Transport for London (TfL) has seen a surge in commuters paying for journeys with their mobile devices in the months since Apple Pay launched.

Its latest statistics show that more than 35,000 people a day now tap in and out of the tube using their mobile devices, and credited Apple Pay, which launched in the UK last July, for the growth.

"The launch of Apple Pay in the UK saw the number of mobile transactions increase sharply," its Commissioner's Report for February 2016 read.

"Apple Pay's launch in July saw a flurry of new mobile devices used on our system, followed by later spikes as issuing banks were added to the Apple Pay system."

In total, 3.2 million commuters used their mobile devices to pay for journeys in the second half of 2015, TfL said.

21/12/2015: Apple has secured a deal to bring its Apple Pay mobile payments service to China. The service willroll out to China UnionPay cardholders in early 2016.

"China is an extremely important market for Apple, and with China UnionPay and support from 15 of China's leading banks, users will soon have a convenient, private and secure payment experience," Apple's head of internet software and servicesEddy Cue said.

The move is important for Apple as the country is responsible for around 25 per cent of its total revenue and a lot of its growth over the last few years.

In November 2014, Apple and UnionPay struck a deal to allow the bank's cardholders to pay for digital goods on Apple's App Store.

Apple Pay will work on UnionPay's recently-launched contactless payment service Quick Pass. The Quick Pass digital wallet supports cards from 20 Chinese banks.

The Apple service will compete against rivals Alipay and WeChat in China. Financial terms of the deal were undisclosed.

22/11/2015:Apple and Mastercard are allowing people using the two to get free travel on the London Underground for the next three Mondays until Christmas.

Customers just need to touch in and touch out using their Apple iPhones or Apple Watches on London Buses, London Underground, London Trams, Docklands Light Railway, London Overground, TfL Rail, Emirates Air Line, and most National Railin the capital.

The money spent will take up to 28 days to be refunded and Mastercard will repay users up to 27.90 for each day's travel.

17/11/2015:TSB and Tesco Bank have joined the Apple Pay program meaning all but one of the major UK banks now support the payments platform. Customers having problems registering their cards should consultTSBandTesco Banksupport pages for further information. TSB is offer five per cent cashback on the first 100 spending each month.

Barclays still hasn't joined, but its current guidance is that it will be available "early in the new year.

12/10/2015:Barclays customers will finally be able to use Apple Pay, it has been confirmed ... but not until 2016.

Customer Mike Jobson went all the way to the top to find out why one of the country's largest banks isn't yet offering the service, emailing the CEO of Barclays Retail Banking in the UK, Ashok Vaswani.

"I am writing to you to complain about the complete lack of attention and care you have paid to your customers over the Apple Pay situation you seem to be ignoring," said Jobson.

"You only have to look at comments on your social media output to see that most customers want Apple Pay and are prepared to switch banks for it. Why don't you just get on the Apple Pay train before you get left behind?" he added.

It seems the terse email has paid off. While the official line until now has been that Barclays "will make an announcement on timing in due course", Vaswani told Jobson: "We have signed up for ApplePay (sic) and will launch it very early in the New Year. We truly value your custom and hope that you continue to bank with us particularly since we are launching this shortly."

How early is very early? Customers like Jobson would surely hope the first half of January, but experience tells IT Pro it can translate to Q1. Either way, Barclays customers will, as Jobson said: "have to sit it our for a few (many?) months or switch banks".

14/09/2015: Apple Pay can now be used by customers of Lloyds Bank, Halifax, and Bank of Scotland, as the trio today announced their support for the payments platform two months after its UK release date of 14 July.

Other banks including HSBC and First Direct already support Apple Pay, as well as NatWest, Nationwide, and Santander.

But notable absentees include Barclays, which has launched its own rival payments platform for customers.

The transaction limit for the contactless payment system is now 30, up from 20, after the government introduced the higher spending barrier at the start of September.

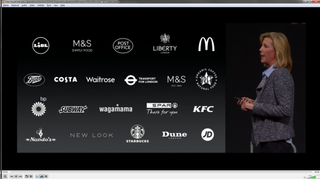

Users can pay for goods and services in around 250,000 UK shops, including Boots and Waitrose.

07/09/2015: Apple looks set to bolster the number of mobile wallets using contactless payments to 200 million by the end of 2016, up 100 per cent from 2014, according to a study by Juniper Research.

The analyst outfit said that while historically growth has been driven by P2P (Person to Person) services for those without bank accounts in developing markets, the launch of Apple Pay has "prompted a hive of activity in the contactless arena".

It argued that with public awareness of contactless heightened in the wake of Apple's launch, competing services such as Samsung Pay and the forthcoming Android Pay would no longer need to seed the market.

The research found that a number of banks were partnering with Visa or MasterCard to implement own-brand contactless wallets using a cloud-based secure element.

The analyst firm said that the MCX (Merchant Customer Exchange) Consortium had postponed the launch of its own contactless service, with several retailer partners now abandoning their closed shop' stance towards Apple Pay. It added that the consortium has not agreed terms with any leading card holders, citing the high transaction fees as a stumbling block.

"By the time MCX launches, US consumers will have a choice of perhaps half a dozen other mobile wallet solutions, not to mention the fact that an increasing number will also have contactless payment cards. In addition, the reliance on store brand payment cards could ultimately be a fatal flaw for the service," said Dr. Windsor Holden, author o Juniper's Mobile Wallets - The Future of Cash whitepaper.

The research also found that wallets run by mobile operator consortia continue to fare badly, with the UK's Weve dropping its planned wallet, and Softcard folding in the US.

28/07/2015: HSBC and First Direct have finally launched support for Apple Pay in the UK. Both banks will allow debit and credit card holders to pay for travel on London Underground, Starbucks and other retailers supporting Apple Pay.

HSBC was supposed to be a launch partner for the payment technology, but was late to the party because of an unspecified "technical error". The bank accidentally tweeted the launch date of Apple Pay before it was officially announced.

Royal Bank of Scotland, Halifax, Lloyds, M&S Bank and TSB Bank are still listed as "coming soon" on Apple Pay's UK website.

Tube passengers using Apple Pay face penalty fares if their iPhone or Apple Watch runs out of battery, warned Transport for London (TfL).

Anyone using Apple's mobile payment app to travel on the underground, trains and buses must ensure their device has enough charge to show ticket inspectors they have paid for their journey, said TfL.

The transport operator has accepted Apple Pay as a contactless payment method since its launch on 14 July, but told passengers they would be charged the maximum fare if their device dies in the middle of a journey, meaning they cannot use it to touch out' at the end.

If ticket inspectors cannot read dead iPhones or Apple Watches on their readers, passengers will be forced to pay penalty fares, TfL added.

A page on TfL's website read: "Your iPhone or Apple Watch must be switched on to use it to travel. You should also check that you have enough battery on your iPhone or Apple Watch to complete your journey."

People must also stick to either their iPhone or Apple Watch when tapping in and out with Pay, as TfL's ticket barriers will not register one journey using multiple devices.

The problem is a result of Apple Pay's security measure to stop card details being stolen - instead of releasing card details to a payee when a transaction occurs, Pay issues a unique ID for each separate transaction.

That means it would issue one for an iPhone, and a separate one for an Apple Watch, even if they were both used on the same journey.

TfL added: "If you keep a contactless payment or Oyster card in your phone case, you should remove it before using your iPhone to touch in and out. If you don't, you could pay for your travel with a card you did not intend to pay with."

Reports of Apple Pay users getting into trouble on the tube have already emerged, with people saying sweaty fingers have given Touch ID difficulty registering fingerprints, as well as blaming Pay for taking longer to register at a barrier than Oyster cards.

14/07/2015:Apple Paylaunched today in the UK, allowing people to swap their credit and debit cards for quicker payments made via iPhone or Apple Watch.

Its release means Apple customers who own the latest range of devices can buy goods and services worth up to 20 by simply holding their smartphone or smartwatch near a contactless reader.

The UK launch is the first overseas expansion of Apple Pay, which launched in the US in October last year, and can be used after downloading the latest version of iOS, version 8.4.

Adoption in Britain will outpace the "modest" uptake seen in the US, according to analyst house Forrester, which pointed to a more established contactless payment ecosystem in the UK.

Analyst Thomas Husson added: "The inclusion of Transport for London as a partner is a way to raise awareness and accelerate daily usage. Apple will [also] benefit from a larger installed base of compatible devices and from the awareness created by the media buzz from the US launch."

Apple Pay can I use it?

Only Apple customers can use Apple Pay and only those who own one of Apple's latest devices.

The iPhone 6, iPad Air 2 and iPad Mini 3 are all Apple Pay compatible because they offer both Touch ID - Apple's fingerprint sensor technology. Only the iPhone 6 (and its bigger counterpart, the 6 Plus) can be used in physical bricks and mortar shops though as iPads lack the necessary Near Field Communication (NFC) chips which allow Apple Pay to communicate with contactless payment readers. Apple's tablets can still use Apple Pay to authorise purchase in apps.

Owners of the tech giant's much-vaunted Apple Watch can also use Apple Pay.

Apple Pay how does it work?

Pay acts like many other digital wallets out there by integrating your credit or debit card into an app.

Specifically, Apple uses Passbook to store your card details, and there is no need to open the app to make a payment. Passbook will be renamed Wallet in the upcoming iOS 9.

Similar to other contactless payment methods, Apple Pay uses NFC to communicate with contactless payment readers, but it relies on extra security measures than banks' contactless credit or debit cards.

These measures are two-fold one uses Touch ID, Apple's fingerprint sensor, to ensure it is you who is making the payment.

The other, tokenisation, issues a one-time code to the retailer receiving payment to ensure the transaction is only completed once. Plus, the one-time code means any hackers that breach the retailer's systems won't gain access to your card details.

Apple Pay how do I set it up and use it?

As usual with Apple, the set-up process is sleek and simple. All you need to do is add your credit or debit card details from your iTunes account to Passbook by entering the card's security code.

Extra cards can be added within Passbook by tapping the plus' sign, then following the instructions on-screen.

Those using iPad Air 2 or iPad Mini 3 can open Settings, tap Passbook & Apple Pay', then choose to add a credit or debit card.

To set it up on your smartwatch, simply open the Apple Watch app on your iPhone and follow the same process.

For iPhone 6, iPad Air 2 or Mini 3 users, there's no need to open your Passbook app or wake your phone up when using Apple Pay. Instead, the NFC chip communicates with the contactless reader when you hold your phone near it.

Simply holding your finger on Touch ID during this process verifies the payment is not fraudulent, and the phone will vibrate and beep when the transaction is complete.

All Apple Watch users need to do is double click the side button and hold the smartwatch display up to the contactless reader the same vibration and beep signify that your payment is complete.

Apple Pay which banks and credit card companies support it?

A whole host of banks have already signed up to support Apple's new innovation, including Royal Bank of Scotland, NatWest, Santander, Citi, American Express, Ulster Bank and Nationwide.

More are expected to offer support in the autumn, including Lloyds, Halifax, M&S Bank, Bank of Scotland and TSB.

However, despite HSBC being listed as a launch partner, and leaking the official release date on Twitter a day early, it expects to introduce the service by the end of July.

Meanwhile, Barclays has decided to take its time, simply saying it would introduce it "in the future".

Both Visa and MasterCard cards are compatible with Apple Pay, and both providers claim they bring additional security to the payments process.

Visa Europe said its tokenisation technology underpins Apple Pay, by providing a one-off number to each payment, to ensure each transaction goes through only once.

MasterCard's Digital Enablement Service uses EMV cryptography on top of Apple Pay's own measures.

Apple Pay how much can I spend?

An existing 20 cap limits the sum of any single transaction, but this will rise to 30 in September.

Higher value payments can only be made when retailers have upgraded their contactless software, according to Visa Europe, which expects 80 per cent of terminals to be able to accept these by the end of 2015.

Apple Pay where can I use it?

You can use Apple Pay in just about any shop that uses contactless readers, of which there are 2.6 million terminals across Europe, according to Visa Europe.

Reports of people using it at Tesco, Starbucks, and other retailers have emerged while Apple has officially partnered with Transport for London (TfL) to enable Pay on the capital's public transport.

TfL's customer experience director, Shashi Verma, said: "With around one in ten of all contactless transactions in the UK now taking place on our transport services in London, we are delighted to welcome Apple Pay as another new and convenient contactless way for our customers to pay for their travel.

"I would encourage anyone who uses pay as you go to try contactless. There's no need to top-up, just touch in and out with your mobile device, credit or debit card."

Other launch partners include Boots, Waitrose, M&S, Post Office, McDonald's, Costa Coffee, Nandos, BP and Pret A Manger.

Online, you can use Apple Pay with easyJet, Just Eat, Hailo, Topshop, Zara, Miss Selfridge, British Airways, Addison Lee and Argos.

Apple Pay who are its rivals and how will it affect banks?

Despite what the launch data hubbub might lead you to believe, Apple Pay is only the latest in a line of mobile payment offerings.

Google is set to launch Android Pay, which also uses NFC, as part of its Android M operating system later this year, while Samsung revealed Samsung Pay at Mobile World Congress.

This will be compatible with Samsung's Galaxy S6 and, likes its rivals, uses NFC.

Existing digital wallets like PayPal are having to adapt to Apple Pay. Apple's payments system could, in the tradition of its other products, remake the mobile payments industry in its own mould.

PayPal is adapting by planning to enable businesses to accept Apple Pay via its own PayPal Here card reader, while its mobile payments arm, Braintree, will support Pay with a new SDK.

"At Braintree, we're continuously expanding our platform to enable merchants to deliver the best commerce experiences, and our extension of Apple Pay support to UK developers furthers our mission to support multiple wallets," said general manager of mobile, Aunkur Arya.

While Apple Pay experienced relatively slow take-up in the US, the UK is much more ready to accept such a product.

Last week, Visa Europe announced one billion contactless payments occurred across Europe in the last year, while it predicts people will spend 1.2 billion a week via contactless by 2020.

Despite this popularity, banks have been relatively slow to respond. Notably, Barclays and HSBC, both of which did not support Pay at launch, have their own rival services.

HSBC's Paym can send money using only a mobile number via the bank's mobile banking app while Barclays' bPay is an NFC device users can buy as a wristband, key fob or sticker.

But Apple Pay could cause problems for such innovations, according to application analysis firm App Annie.

Danielle Levitas,SVP of research and analysis said: "The launch of Apple Pay has the potential to shake up the banking and payments industries. Although Apple Pay is not the first of its kind, the company's reach and ability to evangelise is central to driving mobile payments adoption.

"Apple doesn't need to have a monopoly in payments to drive change in consumer behaviour and retailer POS systems. Delivering a best in class service that is widely promoted, Apple has the ability to turn another sector on its head."

However, other rival services are in the works, such as Zapp, which will launch in October with the backing of Sainsbury's, Asda, House of Fraser, Thomas Cook, HSBC, First Direct, Nationwide, and Santander.

Additionally, Barclays has confirmed it will also support Zapp at launch.

While a wide range of offerings will ensure Apple doesn't have a monopoly on the mobile payments market, companies that fail to adapt to the new technology will fall behind, warned Fujitsu.

Sarah Kellett, associate director of consumer-facing industries, said: "Retailers who fail to see the opportunity with Apple Pay and mobile payment services risk placing a barrier at the point of sale.

"Ultimately the more payment options available to customers, the easier it will be for retailers to make transactions and as a result, sales."

Some of the big financial names are noticeable by their absence, probably because they currently have their own contactless payment methods that will compete with Apple Pay.

The UK launch of Apple Pay will see it available in more than 250,000 locations - many more than when it was first made available in the States.

Apple Pay has gained support from many of the retailers UK consumers know and love.

UK users will also be able to pay for journeys on London Transport using Apple Pay. Apple's current Passbook app will also be rebranded as Apple Wallet, the company confirmed during the WWDC keynote, reflecting its new status for managing stored payment and store cards in addition to loyalty cards and tickets.

Users will be able to pay for bus and tube journeys in London in the same waythey do currently with their Oyster Cards when Apple Pay comes to the UK.

But will Apple Pay prove popular in the UK - and elsewhere around the world - and will it ever truly replace other forms of payment such as cash and card (read our feature on contactless payments for more information)?

Dennis Jones, CEO of UK mobile payments company Judo Payments, seems to think so.

"Apple Pay coming to the UK is the next step to not just a cashless, but also cardless society which I believe is just years away. Apple starting with 250,000 locations in the UK shows Apple's commitment to a larger launch than in the US," he said.

"For us in the UK's capital we can say goodbye to the Oyster card with Apple Pay's seamless process coming to TfL from July. Not only that but Apple Pay is coming to social in the form of immediate payment using Pinterest pins this area seems rife for expansion in the coming months/years."

Apple is not alone in the contactless space. In addition to some of the big financial names having their own offerings, many of Apple's traditional competitors have also launched their own payment methods. Indeed, Samsung Pay and Android Payboth look set to challenge Apple for the contactless throne.

Samsung revealed its rival service at MWC in March, for which the company partnered with MasterCard. Unlike Apple Pay, however, Samsung Pay doesn't use NFC and will be compatible with magnetic-stripe technology.

Android Pay, meanwhile, will be released with the new Android M mobile OS later in 2015, but Apple has the notable advantage of being compatible with smartwatches.

Banks had previously been slow to take the service up, but the beginning of 2015 has seen many more choose to support Apple Pay, including smaller or local banks. Apple claims that 220,000 stores across the US including McDonalds and Macy's currently accept the service.

At the end of 2014, the Telegraph reported that UK banks were concerned about privacy with Apple Pay, with one stating it was "uncomfortable" with the personal and financial data the service would collect on users. This may explain why Barclays was one of the few major British banks not currently supporting Apple Pay.

This story was first published on 12/01/2015 and has been updated several times (most recently on 21/12/15) to reflect new information and developments.

ITPro is a global business technology website providing the latest news, analysis, and business insight for IT decision-makers. Whether it's cyber security, cloud computing, IT infrastructure, or business strategy, we aim to equip leaders with the data they need to make informed IT investments.

For regular updates delivered to your inbox and social feeds, be sure to sign up to our daily newsletter and follow on us LinkedIn and Twitter.