Lloyds says Hello to Windows biometrics

Pilot will use facial or fingerprint recognition to log into online banking

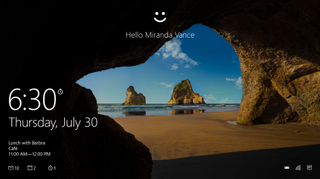

Lloyds Bank is to trial biometric authentication for online banking services, using Microsoft's Windows Hello.

The bank will test biometric authentication for customers logging into their Lloyds, Halifax and Bank of Scotland web banking sites with Windows Hello on Windows 10 devices, to enable customers to access banking services using fingerprint or facial recognition software, instead of typing in a password.

The pilot will run in the second half of this year.

It will use inbuilt infrared cameras on Windows 10 devices to identify faces, so customers can be recognised in a variety of lighting conditions. This uses a data representation of a face, not an image Lloyds Bank said this would prevent access via an impersonator using a photograph.

"This Lloyds Banking Group pilot marks another significant step towards an era of more personal computing," said Ryan Asdourian, Microsoft UK's Windows and devices lead.

"With more than 400 million active users of Windows 10 able to take advantage of Windows Hello, it's great to see a major financial services institution looking at how it can apply this technology to transform the customer experience.

"Windows Hello enables users to log in to a Windows device in less than two seconds and this use of advanced biometric technology will provide Lloyds Banking Group customers with a more seamless and frictionless experience without compromising security."

Get the ITPro. daily newsletter

Receive our latest news, industry updates, featured resources and more. Sign up today to receive our FREE report on AI cyber crime & security - newly updated for 2024.

Gill Wylie, COO of group digital & transformation at Lloyds Banking Group, said: "With customer experience and security at the forefront of our minds, we are keen to run this pilot to explore the new functionality Windows Hello could give our customers."

Customers will still be able to use passwords if they desire, said the bank. It added that customers can opt out of using Windows Hello at any time.

It comes after HSBC announced it would roll out voice recognition technology to 15 million customers over the summer of 2016, while it allowed users to link their Apple ID fingerprint technology to their bank accounts via mobile banking. Santander launched SmartBank last spring to allow customers to ask questions about their spending.

Rene Millman is a freelance writer and broadcaster who covers cybersecurity, AI, IoT, and the cloud. He also works as a contributing analyst at GigaOm and has previously worked as an analyst for Gartner covering the infrastructure market. He has made numerous television appearances to give his views and expertise on technology trends and companies that affect and shape our lives. You can follow Rene Millman on Twitter.