Premature results post sees Google shares slide

Search giant's quarterly results disappoint investors, as growth of mobile devices hits ad prices.

Google's quarterly results fell well short of Wall Street's expectations after its core advertising business slowed, stunning investors and wiping more than 9 per cent off its market value.

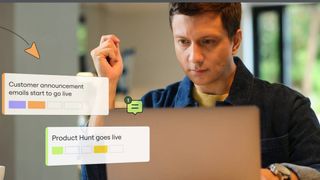

The disappointing numbers came hours ahead of schedule in a rare instance of premature filing. Google blamed the misfire on an unauthorised filing by its financial printers, RR Donnelley & Sons Co.

The earnings report, which had not been expected until after the market close, revealed a weakening in Google's core internet advertising business and persistent losses at its recently acquired cellphone business, Motorola Mobility.

Click ad prices declined for the fourth consecutive quarter. This is the mobile problem.

Shares of Google finished Thursday's regular trading session down 8 per cent at $695 after a brief trading halt. Some analysts said the inadvertent results release spurred confusion and exacerbated its stock price decline.

Google executives maintained in a conference call on Thursday that the company's various businesses continued to benefit from healthy growth and that Google was well-positioned to capitalise on consumer's increasing use of mobile devices.

Chief executive Larry Page, speaking on his first earnings call since an unspecified voice ailment sidelined him from public speaking in June, said Google's mobile business was now generating revenue at an annualized run rate of $8 billion.

Get the ITPro. daily newsletter

Receive our latest news, industry updates, featured resources and more. Sign up today to receive our FREE report on AI cyber crime & security - newly updated for 2024.

Page acknowledged that mobile ad rates were below the rates that Google garners for ads that appear on its standard website. But he said the variety of web-connected devices used by consumers is creating "a huge new universe of opportunities for advertisers."

"We're uniquely positioned to get through that transition and to really profit from it," Page said, citing Google's Android mobile software, the world's top operating system for smartphones by market share.

Google, which has been struggling to turn around a Motorola Mobility hardware business it bought for $12.5 billion, reported a 20 per cent dive in net income to $2.18 billion. Excluding certain items, it earned $9.03 a share, vastly underperforming the $10.65 analysts had expected, on average.

"We have been saying this thing was ripe for a pullback. It's not like they're Google not being Google, but you still have some major issues," said BCG analyst Colin Gillis.

"Click prices declined for the fourth consecutive quarter after rising for eight consecutive quarters before then. That's a negative. This is the mobile problem."

"The other bit is the Motorola millstone had been ignored by the market, and - boom - now you've got weak revenue from Motorola. When you acquire a business and you're about to whack all kinds of people and close offices, you know what happens to the employees? They take their eye off the ball. Sales are down," Gillis explained.

Net revenue growth at Google's main internet business increased 17 per cent year-over-year, the first time growth in that business has fallen below 20 per cent since 2009.

Google finance chief Patrick Pichette stressed on the conference call that the revenue growth rate was higher if the impact of foreign currency exchange rates was backed out.

"It was just too rapid a deceleration," said Pivotal Research Group analyst Brian Wieser. "Many of the same underlying trends drive Facebook advertising."

Shares of Facebook Inc, which headed south shortly after Google's inadvertent filing, closed down 4.6 percent. Google's snafu recalled Facebook's debut, which was marred by technical glitches that also spooked traders and contributed to the stock's first-day decline.

The decline in Google's shares come after a three-month run-up in its stock, which reached an all-time high of $774.38 earlier this month.