HP

Latest about HP

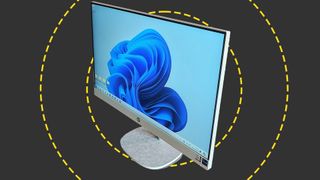

HP All-in-One 27 review: The perfect PC for anyone wanting a simple solution to their general computing needs

By Alun Taylor published

Reviews A capable all-in-one Windows PC that's easy on the eye, the ear, and the wallet

HP Deskjet 2710e review: A cheap compact printer that won’t exceed your expectations

By Stuart Andrews last updated

Reviews A well-designed unit, but the HP Deskjet 2710e has slow speeds and so-so print quality, you get exactly what you pay for

AI PCs are set to surge in popularity in 2024, but vendors might find it hard to differentiate offerings

By Ross Kelly published

News AI PCs are moving beyond the hype stage as analysts forecast significant signs of growth in this rapidly emerging market

HP Envy Move review: An all-in-one you can take anywhere – around the home

By Bobby Hellard published

Reviews A hard sell for IT decision-makers, but a great all-in-one, nonetheless

There's officially no escape from AI PCs

By Ross Kelly published

Analysis Manufacturers clearly view AI PCs as a way to overcome recent revenue slumps and load devices with new productivity-enhancing features

Global PC market primed for rebound in Q4 2023, Gartner says

By Ross Kelly published

News The prediction follows eight consecutive quarters of decline in the global PC market

The AI-powered PC: From personal computer to personal companion

By Bobby Hellard published

In-depth HP Imagine 2023 dares us to dream of a work machine that goes beyond the keyboard and mouse

Take your workforce to the next level with an HP Workstation

By ITPro published

Sponsored If you're looking to boost your enterprise computing power, HP Workstations could be the ideal choice.

Get the ITPro. daily newsletter

Receive our latest news, industry updates, featured resources and more. Sign up today to receive our FREE report on AI cyber crime & security - newly updated for 2024.