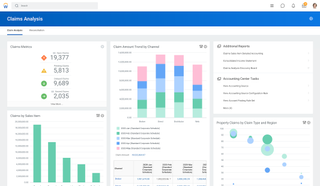

Workday's Accounting Center helps businesses manage financial data

The company's updated Adaptive Planning platform also transforms how customers engage with data

Workday, a leading provider of enterprise cloud applications for finance, HR and planning, has announced the release of its new Workday Accounting Center and machine-learning-driven predictive forecasts for Workday Adaptive Planning.

“We continue to deliver on our vision for the changing world of finance by expanding data management, self-service analyses, and machine learning-fueled processes to help finance leaders better navigate continuous disruption and change,” said Barbara Larson, general manager at Workday Financial Management.

Workday Accounting Center enables customers to manage operational and financial data from multiple sources with a single point of control enterprisewide.

By enriching operational data with meaningful and strategic attributes, organizations can turn data into accounting and insights faster, eliminating the need for finance teams to rely solely on information technology (IT) to maintain accounting rules.

For example, with Workday Accounting Center, not only can an insurance company create accounting entries for operational transactions, but it can also report and analyze those transactions with full drill-down and visibility into the source transactions.

The predictive forecasting embedded in Workday Adaptive Planning’s analytics engine helps estimate likely outcomes for revenue, expenses and other critical business variables using machine learning. The forecasts are derived based on a wide array of data points aggregated from across the enterprise, including sales, HR, marketing and operational data.

The machine learning algorithms also detect anomalies and automatically flag potential issues so organizations can make informed decisions.

Get the ITPro. daily newsletter

Receive our latest news, industry updates, featured resources and more. Sign up today to receive our FREE report on AI cyber crime & security - newly updated for 2024.

Key advances for customers in the office of the CFO include:

- Embedded ad hoc analysis on real-time data using Discovery Boards

- Ability to publish plans from Workday Adaptive Planning directly to Workday Financial Management and vice versa.

"CFOs and CIOs recognize that they must embrace new digital technologies in order to manage the ever-increasing volume and sources of data required today," said R "Ray" Wang, founder and principal analyst, Constellation Research, Inc.

"And because it's so challenging to move off of legacy systems, leading companies recognize that they need a solution that can scale and evolve over the next decade and beyond. Intelligent data, machine learning, and a robust ecosystem are critical factors for companies when choosing their next partner for financial management systems."