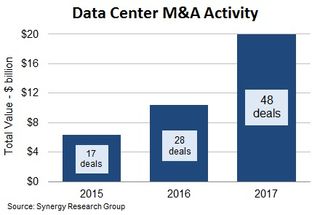

Data centre M&A surge hit $20 billion in 2017

Acquisitions for the period were worth more than the previous two years combined

The data centre industry is experiencing a surge in the number of high-value deals, with the total value of mergers and acquisitions reaching $20 billion in 2017, more than the two previous years combined.

On average through 2017, there was one significant M&A deal agreed every week, according to a new analysis by Synergy Research Group, the largest of these being Digital Realty's $7.6 billion acquisition of DuPont Fabros.

From a total of 48 high profile deals, four of these were valued at a billion dollars or more, involving acquisitions from Equinix, Cyxtera, Peak 10 and Digital Bridge, as well as a further 12 deals valued between $100 million and $1 billion, and 31 deals worth up to $100 million.

That's compared to just 17 deals in 2015, and 28 deals in 2016, which combined only saw three deals worth over a billion dollars, the largest of which was Equinix's acquisition of TelecityGroup for $3.8 billion.

The momentum shows no sign of slowing down, as 2018 has four major deals already agreed but have yet to be signed off, with a combined value of $2.6 billion.

By far the largest players in the industry have been Equinix and Digital Realty, two leading colocation providers that have sunk over $19 billion into M&As from both the 2015-2017 period and pending deals in 2018. Their activity accounted for more than 50% of the M&A value, across North America, EMEA, Oceania and Asia.

Synergy's chief analyst and research director John Dinsdale said that the unprecedented rise is due to a shift in focus for the large industry players.

Get the ITPro. daily newsletter

Receive our latest news, industry updates, featured resources and more. Sign up today to receive our FREE report on AI cyber crime & security - newly updated for 2024.

"Above all else, what is driving the data center M&A activity is enterprises focusing more on improving IT capabilities and less on owning data center assets. That shift is driving huge growth in outsourcing, whether it is via cloud services, or use of colocation facilities, or sale and leaseback of data centers.

"The dramatic growth of cloud providers is also driving changes in the data center industry, as data center operators strive to help them rapidly increase scale and global footprint. We expect to see much more data center M&A over the next five years."

Main image: Bigstock

Dale Walker is the Managing Editor of ITPro, and its sibling sites CloudPro and ChannelPro. Dale has a keen interest in IT regulations, data protection, and cyber security. He spent a number of years reporting for ITPro from numerous domestic and international events, including IBM, Red Hat, Google, and has been a regular reporter for Microsoft's various yearly showcases, including Ignite.