Explore Software

Software

Latest about Software

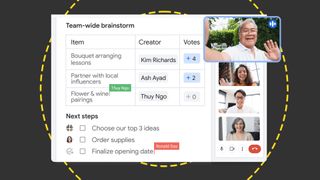

Google Workspace Review

By Ross Kelly last updated

Reviews From free to enterprise, Google’s ever-popular productivity suite has a range of tiers and functions for all sizes of business

One of our favorite productivity suites of 2023 just got a bunch of new AI tools — but they come with a steep price tag

By Ross Kelly published

News Updates to Google Workspace are designed to reduce pressure around taking notes and let workers be more engaged during meetings and calls

Why Flux CD’s survival is another major victory for the open source community

By George Fitzmaurice published

News Despite a rocky road after the fall of Weaveworks, Flux CD is now receiving support from several organizations

Linux Foundation unveils Redis alternative, 'Valkey', with backing from AWS, Google Cloud, and Oracle

By Ross Kelly published

News Valkey will provide developers with an open source Redis alternative following the firm’s move to a more restrictive licensing scheme in March

Trello for business: A complete guide to managing your workflows

By Nik Rawlinson published

Tutorials From the free tier to the enterprise version, ITPro talks you through your Trello workflow, from start to finish

New Windows 10 prices show Microsoft is getting desperate in pushing users to the latest operating system

By George Fitzmaurice published

News The firm has extended support for the operating system, but the hefty price tags show it’s keen to push users to Windows 11

Google devs ditched C++ for Rust — here's what happened

By Steve Ranger published

News Rust developers are twice as productive as their counterparts using other programming languages such as C++

"We got lucky": What the XZ Utils backdoor says about the strength and insecurities of open source

By Steve Ranger published

Analysis The XZ Utils backdoor could’ve caused serious problems for Linux, but luckily a developer spotted the malicious code and prevented disaster

Get the ITPro. daily newsletter

Receive our latest news, industry updates, featured resources and more. Sign up today to receive our FREE report on AI cyber crime & security - newly updated for 2024.